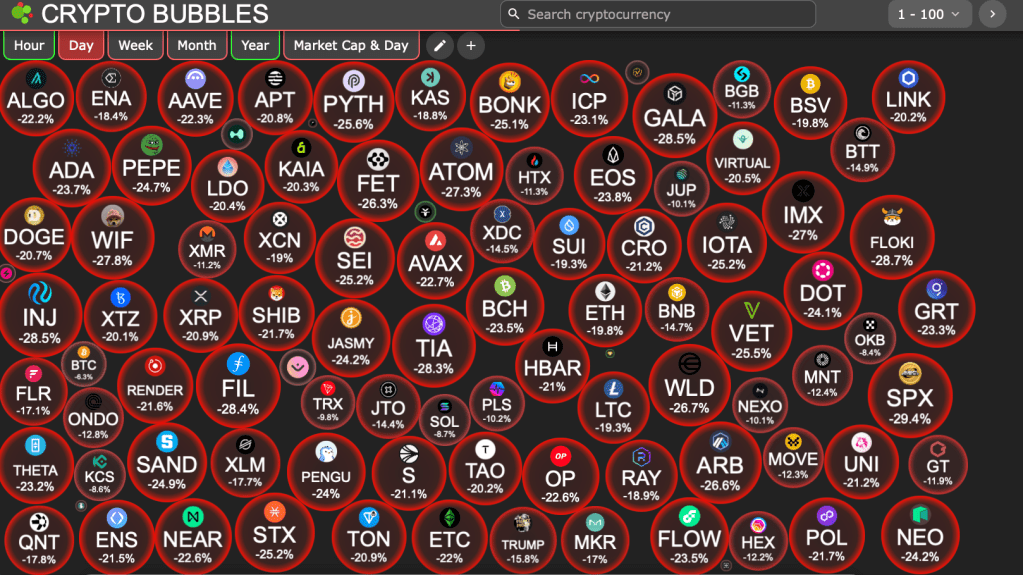

Crypto market faces a major dump in the past few hours, but don’t overlook the good news.

Today, the crypto market experienced a significant downturn, shaking investor sentiment. However, it’s important to stay focused on the bigger picture. Behind the short-term price fluctuations, there’s been a wave of positive developments, especially in the U.S. financial landscape, that signal growing acceptance and institutional interest in Bitcoin. Let’s dive into the key updates:

The U.S. financial market is witnessing significant developments related to Bitcoin, from the federal to state levels, indicating growing interest in this digital asset.

Kash Patel, the nominee for FBI Director under President Donald Trump, currently holds over $100,000 in Grayscale Bitcoin products and an equivalent amount in shares of Core Scientific, a company focused on Bitcoin mining. This signals that high-ranking government figures have a favorable view of the crypto market.

At the state level, Representative Logan Manhart of South Dakota has introduced two bills aimed at integrating Bitcoin into the state’s public investment strategy.

• House Bill 1202 (HB 1202) allows the state to invest up to 10% of its public funds in Bitcoin.

• House Concurrent Resolution 6006 (HCR 6006) encourages the State Investment Council to consider Bitcoin as a hedge against inflation.

Meanwhile, Arizona and Utah are leading the race to become the first states to pass Bitcoin reserve laws, showcasing the expanding role of crypto in public financial systems.

In the financial market, Nasdaq Chairman Nelson Griggs stated that the exchange will be more actively involved in the crypto sector once regulatory frameworks are clarified. This could pave the way for numerous new financial products related to digital assets.

Additionally, MicroStrategy — one of the largest Bitcoin-holding organizations — has increased the scale of its Preferred Stock issuance from 2.5 million to 7.3 million shares, priced at $80 per share, raising $584 million to further acquire more Bitcoin. This move highlights strong investor demand and an oversubscription in the offering.

These developments reflect the growing interest and acceptance of Bitcoin in the U.S. financial system, from government agencies to the investment market.

Other Information:

• The European Central Bank has cut interest rates by 0.25% and left the door open for further easing.

• The Bank of Canada has cut interest rates by 0.25%, bringing them down to 3%.

• The President of the European Central Bank, Christine Lagarde, declared that she believes Bitcoin will not be included in the EU’s reserves. She also held discussions with the Czech National Bank, convincing them to reject plans to accumulate Bitcoin reserves. On the contrary, I expressed confidence that Bitcoin will outlast Lagarde’s term at the European Central Bank. Instead of persuading other countries, perhaps she should try convincing her own son, who is a Bitcoin investor.

• The Czech National Bank (CNB) has officially considered adding new types of assets to its national reserves as part of its diversification strategy. The proposal, initiated by Governor Aleš Michl, aims to assess the potential benefits. Meanwhile, the Czech Finance Minister warned against adding Bitcoin to the national reserves, stating that it is “certainly not a stable asset.” However, the central bank’s governor is pushing for the establishment of a Bitcoin Reserve Fund, proposing a purchase of up to $7.3 billion worth of Bitcoin, equivalent to 5% of the country’s total reserves of $146 billion. This has sparked a conflict between the Czech Ministry of Finance and the Czech National Bank.

• Norway’s central bank fund revealed that it owns $500 million worth of MicroStrategy shares, serving as an indirect way to invest in Bitcoin.

• The Canadian company, Purpose Investments, has filed a preliminary application for the first XRP ETF in Canada.

• Tether reported a profit of $13 billion in 2024, as confirmed by the audit firm BDO. In Q4, Tether hit a record high in U.S. Treasury holdings, amounting to $113 billion (including direct and indirect holdings). Secondly, the total circulating USD₮ supply is 136,613,782,874. The excess reserve fund has surpassed $7 billion for the first time, a 36% increase from the previous year.

• Genius Group Limited announced a rights offering. Starting from January 24, each shareholder is entitled to purchase shares at a significant discount, aiming to raise up to $33 million to acquire more Bitcoin.

Leave a comment